A Peek at Global REITs

The world’s first REIT was created by the U.S. Congress in 1960. Plenty of countries have followed American practices ever since. 2000s has witness a wider and faster spread of REITs, with 15 mature or new-emerging markets, such as Thailand and Bulgaria, setting up their first REIT. 38 countries have adopted the REIT methods by 2018, many other considering introducing too. Below is an animated map to briefly show the development of REITs.

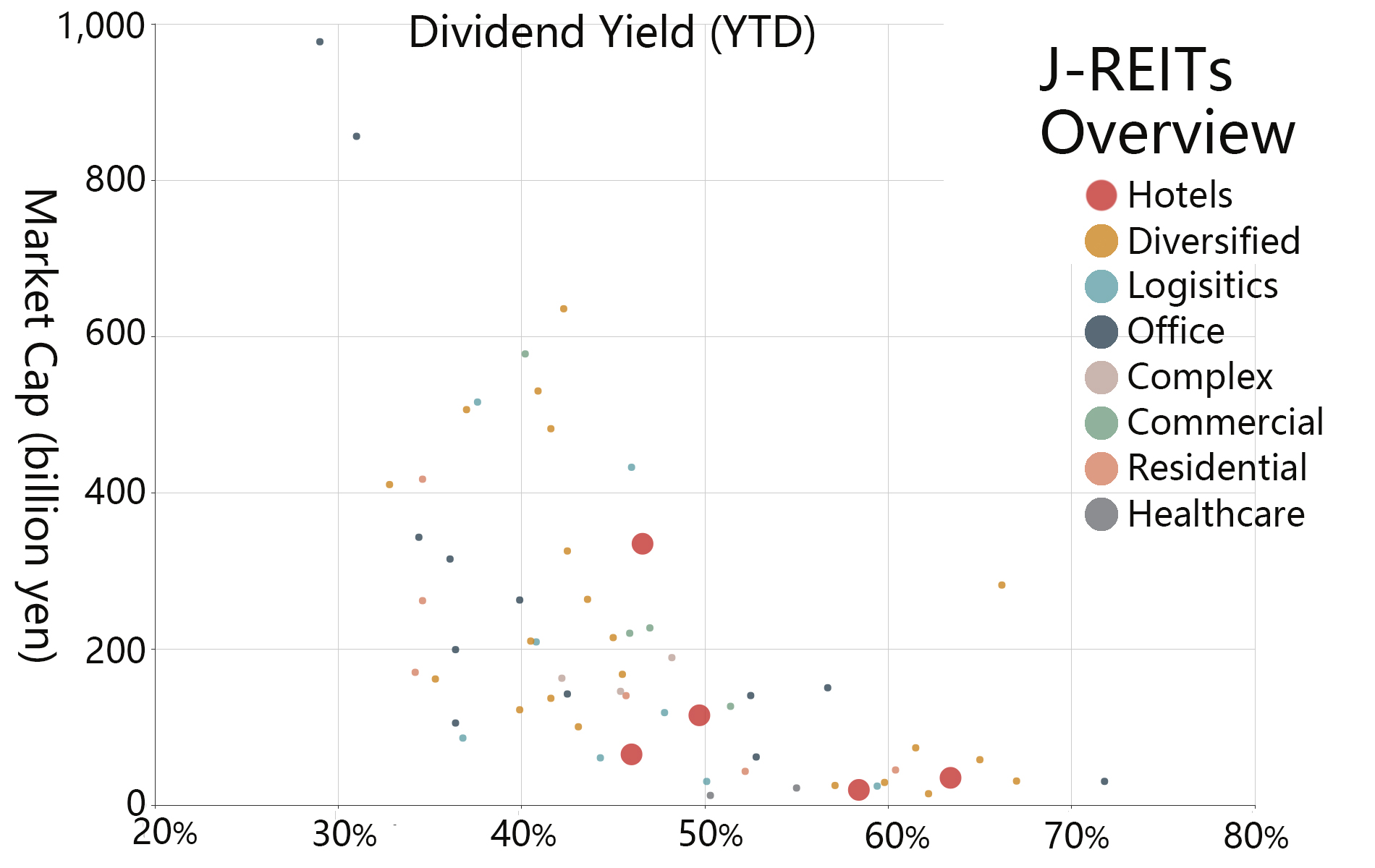

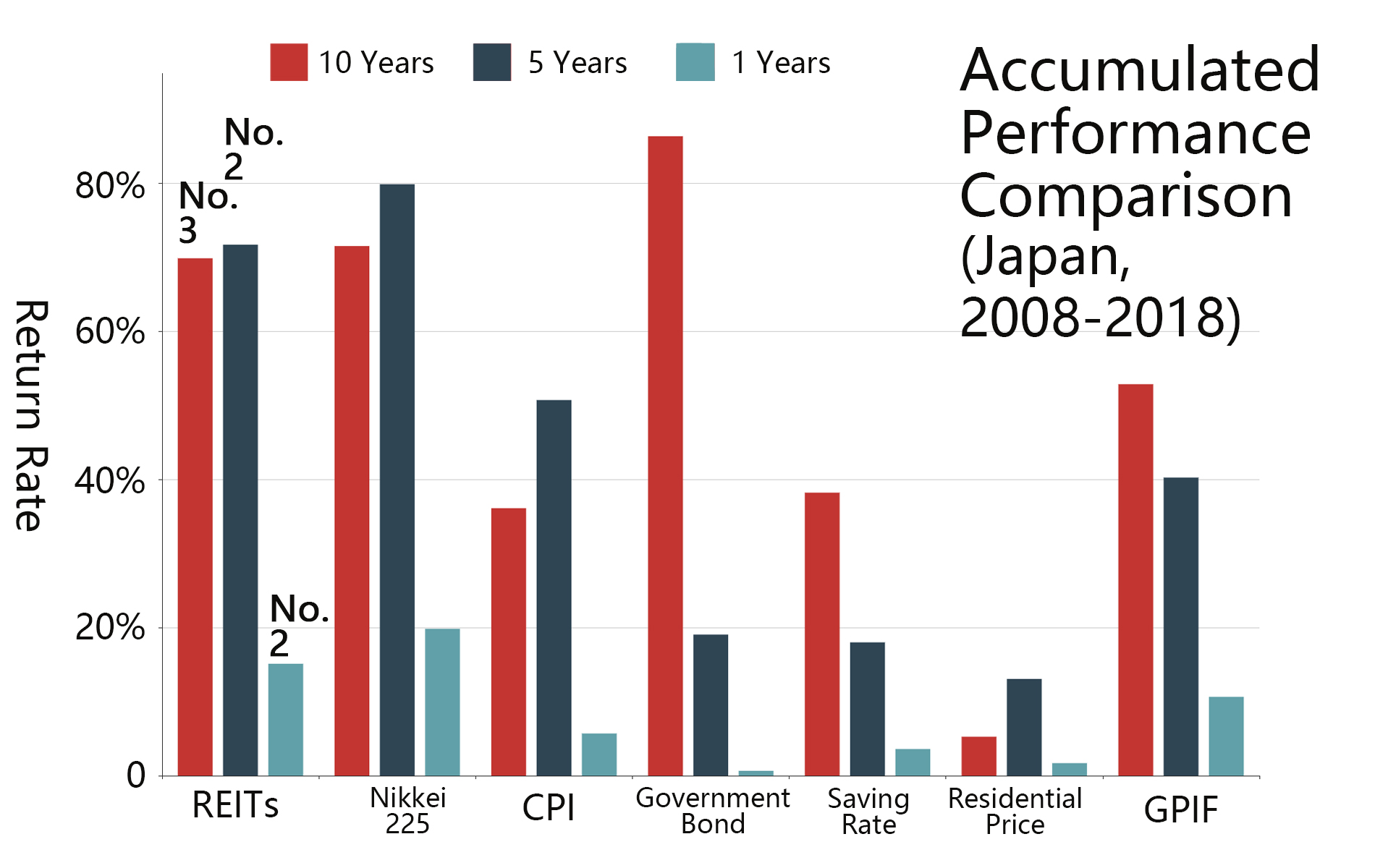

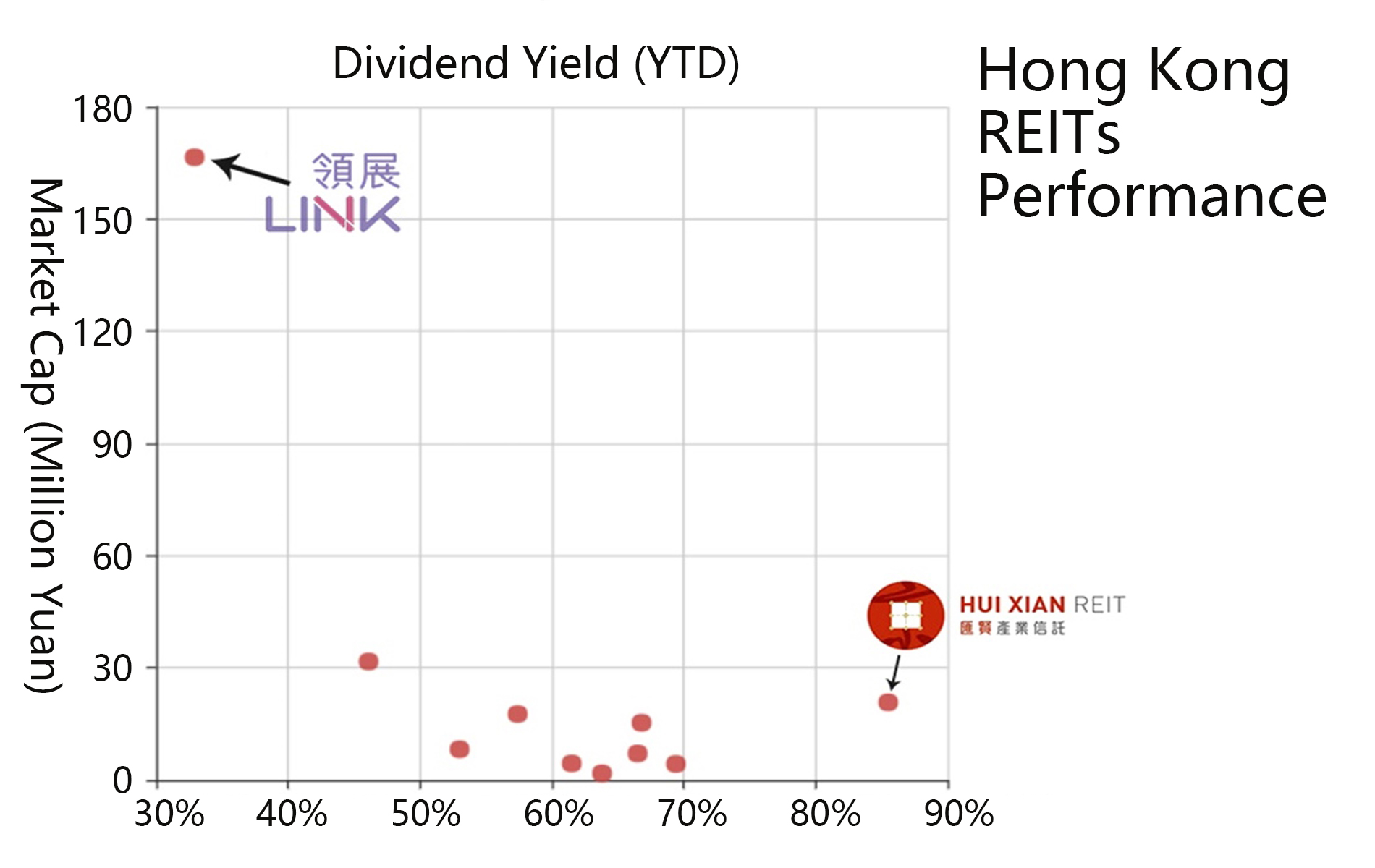

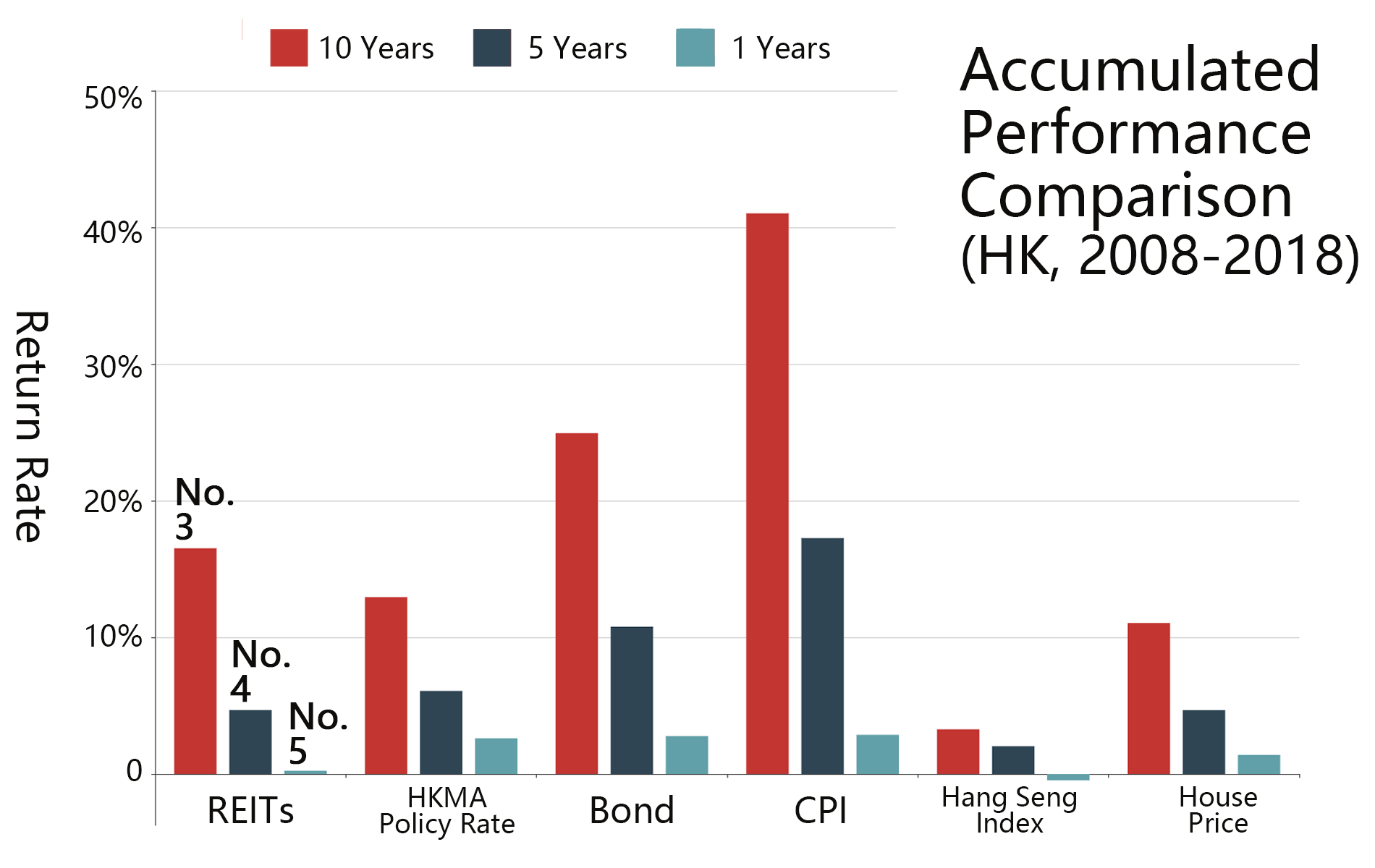

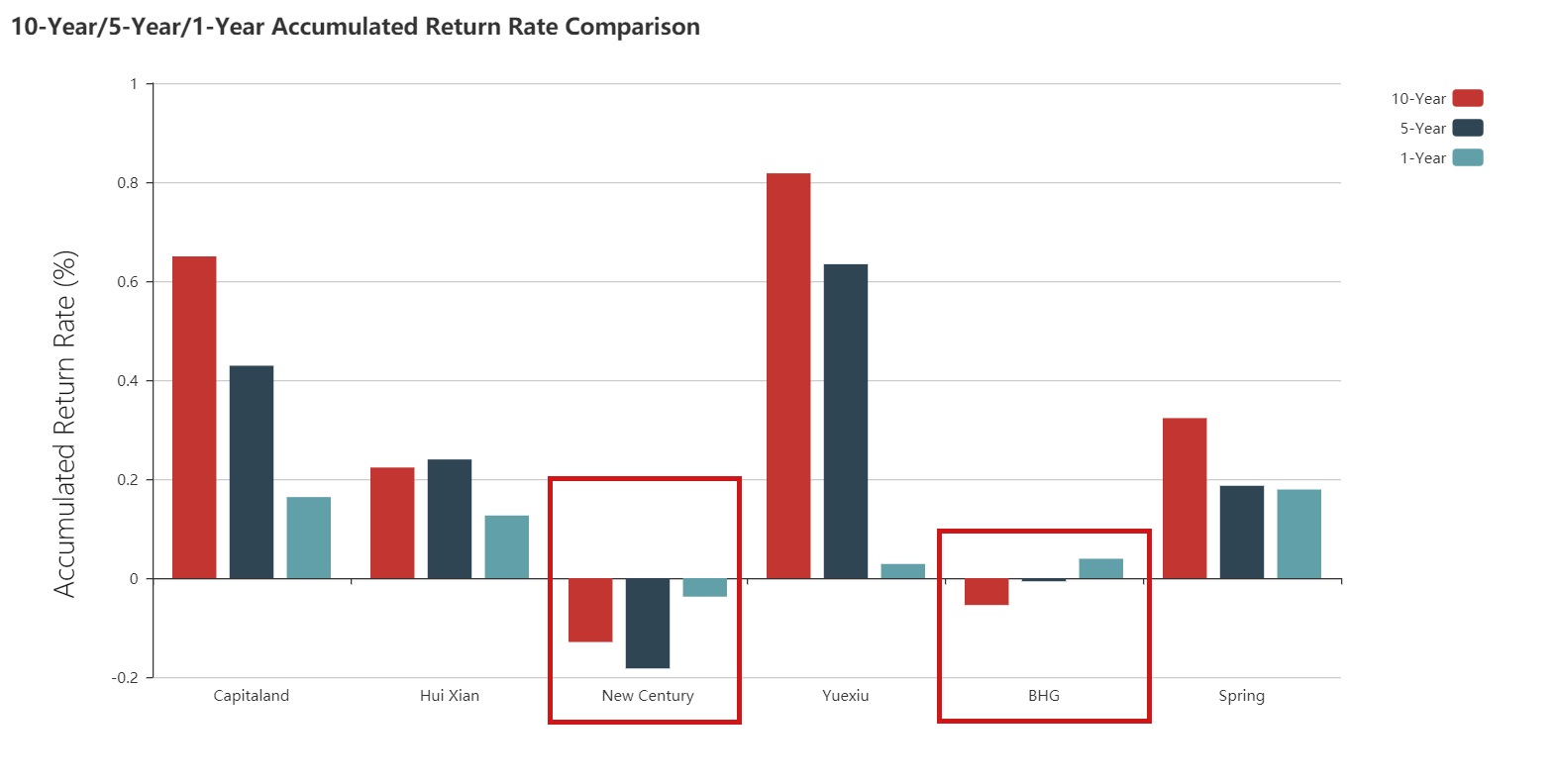

Both the bar chart and the scatter chart show that REITs’ return have dropped over the past year given a weaker property market.

J-REITs performed consistently well over the last decade, outperforming benchmarks and most investment market.

J-REITs which operate hotels comprehensively generate higher return.

HK-REITs are mediocre in the long term, and fell sharply this year due to similar reason with the U.S..

Link (823.HK) has the lowest dividend yield with the largest cap, while Huixian has the highest dividend yield with a medium size.

Based on observation of major markets, the U.S., Japan and Hong Kong, REITs rank the second or the third among mainstream investment products in both long term and short term. Despite less fluctuation, REITs’ returns shrink severely during recession period and demonstrate a delay effect from the change of property prices. Primarily, interest rates also influence REIT’s outcome.